“Trump’s Unprecedented Surveillance Network: Palantir’s Role in Expanding Government Monitoring Capabilities”

“In 2025, the Trump administration deepens its collaboration with Palantir Technologies, leveraging advanced AI tools to enhance domestic surveillance operations.”

Introduction

In 2025, the Trump administration has stepped up its collaboration with Palantir Technologies, a data analytics firm recognized for its work with federal organizations.

This cooperation aims to integrate modern artificial intelligence (AI) tools to improve domestic surveillance and monitoring capabilities.

The plan raises serious concerns about privacy and the risk of further government overreach.

Donald Trump with artificial intelligence background representing government surveillance in 2025″

Expansion of Surveillance Technologies

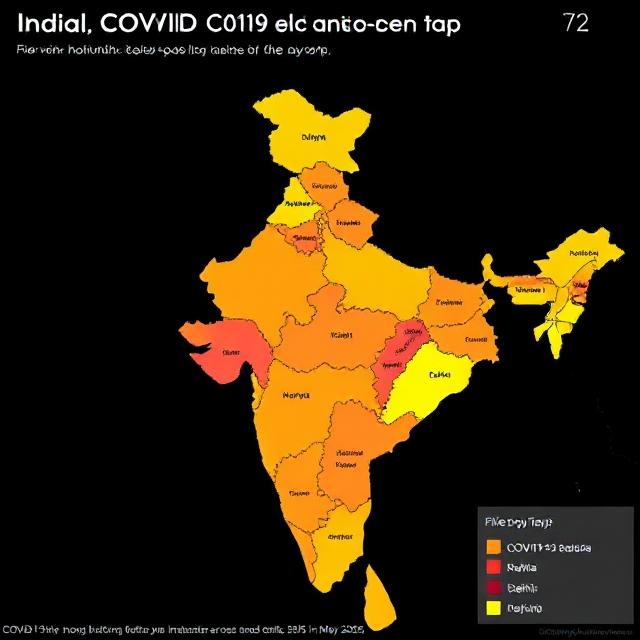

The administration has authorized intelligence agencies, including the National Geospatial-Intelligence Agency (NGA) and the National Reconnaissance Office (NRO), to use satellite monitoring to monitor the United States-Mexico border.

This directive is part of a larger strategy to improve border security and manage immigration.

The NGA has established a task force for this goal, and the NRO is working with the intelligence community to secure the borders.

This project demonstrates the administration’s commitment to using AI and technology to monitor domestic operations.

. Reuters

Palantir’s Role in the Surveillance Framework

Palantir Technologies has received many large contracts to supply AI-powered data analytics tools to several federal organizations. These platforms, which include Foundry, Gotham, Apollo, and the Artificial Intelligence Platform (AIP), are intended to combine and analyze large amounts of data from many sources.

For example, Palantir has deployed its first two TITAN systems to the US Army, which function as mobile ground stations that use AI to collect data from space sensors, supporting soldiers with battle strategy and boosting attack targeting and precision.

. NBC New York+4Investing.com+4Nextgov/FCW+4NBC10 Philadelphia

Palantir has also been awarded contracts worth more than $65 million to deliver data-as-a-service platforms for the United States Air Force and Space Force, with work slated to be completed by mid-2025.

Privacy Concerns and Ethical Implications

The increase of surveillance capabilities through artificial intelligence and data analytics creates serious privacy and ethical concerns. Civil rights campaigners warn that such technology could jeopardize individual privacy and civil freedoms.

The integration of Palantir’s platforms with Microsoft’s Azure Government cloud services exacerbates the problem, as it entails the processing and analysis of sensitive data in classified environments.

Palantir’s Financial Growth Amid Government Contracts

Palantir’s engagement with the Trump administration has aided its financial growth. In the first quarter of 2025, the company recorded revenues of $883.9 million, with a 45% rise in US government revenue. The company now expects yearly revenues of $3.89 billion to $3.90 billion, an increase from previous predictions.

Donald Trump with artificial intelligence background representing government surveillance in 2025″

Conclusion

The Trump administration’s growing relationship with Palantir Technologies represents a dramatic move toward enhanced domestic surveillance using powerful AI and data analytics.

Proponents believe that these measures improve national security, but they also raise serious concerns about privacy, civil liberties, and the ethical use of technology in government operations.

As this collaboration progresses, it will be critical to evaluate its impact on individual liberties and the balance of power between the state and its citizens.